|

Washington’s December federal budget deal offered little relief for public employees – or the rest of us who drive on city streets, send our kids to school, or rely on any of a thousand other public services.

Congress is forcing federal workers to pay more toward their pensions while allocating almost nothing for cash-strapped cities and states. Mayors and governors are gearing up for their own rounds of budget wrangling over cuts versus taxes – the fifth since the financial meltdown.

More than 700,000 city and state jobs have been cut since 2008, and politicians have more bitter medicine in store.

Most public sector unions have failed to counter the conservative message that public workers’ pensions and pay are to blame for yawning budget gaps. Too many have offered preemptive concessions, hoping to fend off more severe cuts. Too few have been willing to defend their job standards or the services they provide, much less tackle the third rail of US politics – raising taxes.

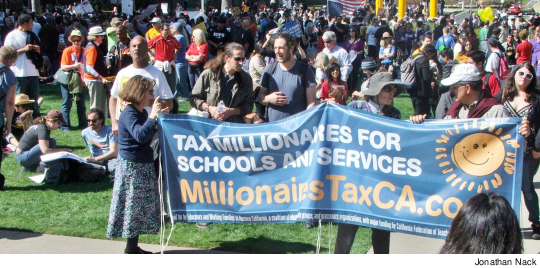

But unions and allies who have called for raising taxes – on the rich, not on their fellow workers – have won public support. More often than not, they’ve succeeded at raising revenue.

Spare the 99%

Unions willing to push for new taxes are learning the hard way that calls for “shared sacrifice” get no traction with today’s voters.

Colorado is the most recent example. A $1 billion-per-year education funding package on the November ballot – backed by teachers unions, school districts, the state Democratic establishment and most pro-corporate education “reform” organizations – was defeated two-to-one.

Amendment 66 would have raised the state’s income tax from a flat 4.6% to 5% for individuals earning less than $75,000 and 5.9% for those earning more, earmarking the new money for schools.

In other words, everyone would have paid more, not just the well-to-do. And the measure’s implicit definition of “the well-to-do” started painfully low.

Even in more liberal Los Angeles, residents rejected a half-cent sales tax hike in March 2013. The proposal was supported by outgoing Mayor Antonio Villaraigosa and most city unions.

It was pitched as a way to spare police and fire service from further cuts. But voters had already had their fill of regressive sales taxes, which fall disproportionately on poor and working class people.

Tax the Top

The L.A. rejection contrasts sharply with California voters’ 55% approval, just four months before, of Proposition 30, a $6 billion annual tax increase proposed by Governor Jerry Brown.

This was in no small part thanks to the California Federation of Teachers (CFT), which put a competing measure for a “millionaires tax” on the ballot. Brown was forced to prune back Prop 30’s original “shared sacrifice” sales tax component to a relatively tiny amount, as the price for CFT to withdraw its initiative.

What remained was an income tax increase on anyone making more than $250,000 – comprising 90% of the measure’s total revenue.

CFT’s research had shown that “tax the rich” had much broader appeal among California voters than a sales tax. The union emphasized that message in its campaign.

Lawmakers in Minnesota followed the California example in May 2013 – thanks to a big push from union and community allies, who mixed traditional lobbying with the direct action of the Occupy Movement. They passed a tax increase requiring households earning over $250,000 to pay an additional 2%.

In both states, unions and their allies stressed that those who had benefited from the policies that sparked the financial melt-down – corporations and the rich – must pay for the public deficits it produced.

The Chicago Teachers Union (CTU) has taken the same tack. CTU spent two years before its 2012 strike highlighting the city’s tax giveaways to big business. According to the union’s calculations, these subsidies were draining schools of $250 million a year.

Through direct actions – such as holding a “grade-in” in a bank lobby and occupying a subsidized Cadillac dealership – teachers challenged the city’s spending priorities. They offered the obvious answer to the question of where to find money for new books, art supplies and teacher pay.

Fast Food, Quick Change

In New York City, unions and grassroots groups staged a week of action in December, highlighting how the city could save more than $750 million by renegotiating the fees and high interest rates Wall Street charges to manage billions of public dollars.

The protests were designed to reinforce new Mayor Bill de Blasio’s campaign commitment to fighting inequality. De Blasio has pledged to raise taxes on those making over $500,000 to pay for universal prekindergarten. But much more revenue will be required if city workers intend to press him to settle their long-expired contracts with back pay or raises.

When it comes to taxes, public sector unions should take a page from the recent fast-food strikes. With their twin demands for an hourly wage of $15 and a union, fast-food workers leapfrogged nearly two decades of patient organizing intended to raise the minimum wage in steady increments.

Instead of taking the traditional approach of calculating a politically feasible goal, fast-food workers aimed high. With direct action and a lot of publicity, they shattered the parameters imposed by simple legislative maneuvering – and shifted what’s possible.

Their boldness has already produced its first win: a successful ballot initiative for a $15 minimum wage at the Seattle-Tacoma International Airport. Copycat measures are sprouting up across the country.

Worth the Risk

Could public employees do the same for raising state and local taxes? It would mean head-to-head confrontations with both Republicans and Democrats – an approach that contradicts the way most unions have operated for generations.

But the ones willing to cut against the political grain and defy union tradition are finding the politicians aren’t unbeatable…and in fact, the public leans our way.

______________________________

Mark Brenner is director of Labor Notes. A version of this article appeared in its January 2014 issue.