With the slow recovery from the Great Recession of 2008-2009, New York State’s budget situation remains precarious. Most states are in a similar position, since their revenues have dropped more than at any time since the Great Depression of the 1930s. State tax collections, adjusted for inflation, are still 12% below pre-recession levels while the need for state-funded services has grown. At least 46 states struggled in 2010 to close budget shortfalls. There is no letup in sight. Federal fiscal relief to the states has greatly diminished and most of it is scheduled to end in mid-2011.

New York State’s revenues are projected to grow by 5% in the coming budget year, but the winding down of federal fiscal relief will cost New York more than $5 billion, mainly in the areas of Medicaid and K-12 education. The pace of the national recovery is slower than it should be, partly because the continuing pressure on state budgets is forcing states to cut spending and/or increase taxes. Fiscal relief to the states is still urgently needed – yet in August the Democratic-controlled Congress could only muster a modest six-month extension (through the first half of 2011) of increased Medicaid assistance.

RESENTMENT

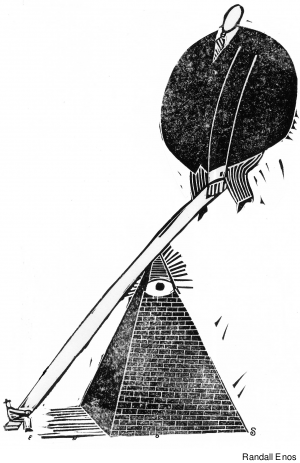

There is tremendous public resentment over the economy. The recession was clearly the result of Wall Street’s excesses, yet conservatives have succeeded in deflecting the focus of public animosity to government. Republicans rode the tsunami wave of economic anxiety and insecurity to victory at the polls, even though they lack any realistic strategy to boost the recovery and reduce unemployment. Now they claim a mandate to reduce government, at all levels, at all cost. Cutting government will exacerbate unemployment and retard the recovery – but for Republican leaders that doesn’t matter, because they believe a still-weak economy in 2012 will lead voters to deny President Obama a second term.

Conservatives have also succeeded in channeling popular resentment against public-sector workers, claiming that their benefits are too high and their compensation now exceeds that of comparable private-sector workers. However, when pay and benefit comparisons are done accurately – by adjusting for the higher education and higher average age of public-sector workers – New York’s government workers are compensated pretty much in line with their private-sector counterparts.

PUBLIC SECTOR

Attacks on public pension funds never mention the tremendous stock market losses pension funds suffered during the financial crash, which were certainly not caused by public employees. Not surprisingly, these attacks often come from political forces who supported corporate raids on private-sector pensions over the last generation, and who are now seeking cuts in Social Security benefits. It’s an agenda that is harmful to the retirement security of all Americans.

New York needs a balanced approach to balancing its budget. Slashing essential public services or scapegoating public-sector workers isn’t the answer. Other major interests, particularly Wall Street, big business, and New York’s ever-richer elite must participate in the solution.

Following the September 2008 financial meltdown, Wall Street firms bounced back sooner than anyone anticipated. Wall Street profits and bonuses in 2010 likely won’t match 2009’s record levels, but they will still be far better than in any other part of the economy. In this weak economy, Wall Street handily makes money because of the Federal Reserve’s low interest rate policy – a policy intended to foster economic recovery. Without a recovery, these are just windfall profits.

SOLUTIONS

In an April 2010 report, the Fiscal Policy Institute and the Center for Working Families advanced several proposals for how Wall Street could help the state’s finances recover from the financial-sector-induced Great Recession. Options include a temporary windfall profits tax, a bonus recapture tax, updating the taxation of financial firms (especially hedge funds), and a reduction in the stock transfer tax rebate.

New York’s corporate community benefits from several corporate tax loopholes and from excessively generous business tax breaks, also known as “tax expenditures,” that were enacted with the hope of promoting economic and job growth. FPI recently estimated that the state “spends” $5 billion annually on a wide variety of business tax expenditures that lack accountability, transparency and effectiveness. Such programs should be closely examined for possible savings.

The job of closing New York’s yawning budget gaps over the last two years has been aided considerably by a temporary increase in personal income taxes on high-income earners. However, the temporary income tax increase is due to expire at the end of 2011. The surcharge – which raised the state’s top tax rate for married couples from 6.85% to 7.85% for income above $300,000, and to 8.97% above $500,000 – generates $4-5 billion a year. It should be extended at least until state tax revenues recover from the recession.

Most of this surcharge is paid by the richest one percent of taxpayers, who have annual incomes over $650,000. A recent FPI report documented that the top one percent increased their share of total income in New York from 10% in 1980 to 35% in 2007, a level of inequality far above the national average. Not surprisingly, New York has the most polarized income of all states. New York City is the most polarized among the largest 25 cities.

The real issue with New York’s tax burden is its regressivity, not that its magnitude is constraining New York’s economic recovery. The state personal income tax is mildly progressive. Yet the highly regressive effects of the sales tax and local property taxes mean that New York’s overall combined state and local tax burden is regressive. Thus, low- and middle-income families pay a higher share of their incomes in state and local taxes than the wealthiest families do. Even with the temporary surcharge, the wealthiest one percent of New York’s taxpayers paid 8.4% of their income in state and local taxes while the middle income quintile or one-fifth of taxpayers paid 11.6% in state and local taxes and the poorest one-fifth paid 9.6%.

To address this regressivity, and to deal with the growing concerns about burdensome local property taxes, New York State needs to rethink its tax structure and revamp the fiscal relations between the state and local governments. Several steps are needed.

REAL TAX RELIEF

New York should significantly enhance the property tax circuit-breaker administered through the personal income tax to provide meaningful property tax relief to those households, including renters, truly burdened by high property taxation relative to their incomes.

The state should aid communities with low property wealth and proportionately high Medicaid usage by increasing the state share of Medicaid costs in a way that takes a locality’s “ability to pay” into account.

REVENUE SHARING

The state should also establish a reasonable schedule for phasing in the additional funding needed by high-need/low-wealth school districts under the 2007 settlement of the Campaign for Fiscal Equity lawsuit; and it should restore the state’s commitment to revenue-sharing with municipalities with significant service needs relative to their resources. These Medicaid, school aid and revenue sharing steps will lessen pressure on the property tax in those communities that have limited property tax bases relative to their service responsibilities.

The STAR program, which currently provides property tax relief to homeowners but which does so in a very ineffective manner, should be reduced to help fund the expanded circuit-breaker and provide Medicaid relief to poorer communities.

New York State should make its personal income tax structure more progressive through higher rates at the top. Before the enactment of the 2009-2011 temporary income tax surcharge, New York families with $50,000 in taxable income paid the same marginal tax rate as families with $500,000 in income – or even $50 million.

Wall Street should contribute to addressing the state’s financial problems that were exacerbated by the finance-induced recession – for example through a windfall profits or bonus recapture tax, or by taxing the hedge fund profits of non-residents.

LOOPHOLES

Finally, the state should seek to close corporate tax loopholes and excessive growth in the cost of business tax breaks.

A balanced approach to balancing the state budget includes identifying additional revenues and not relying on cutting critical services at a time when need has been elevated by the lingering recession. Government spending is inextricably tied to prospects for economic recovery. Steep cuts will worsen unemployment. Public spending in areas such as K-12 education, public higher education, healthcare and infrastructure is needed to help get the economy moving again.

Public investments in our collective physical and human capital will enhance both the recovery and our long-term productivity. New York needs a smart approach to our fiscal problems – and that means thinking beyond a list of budget cuts.