Preserving And Extending Benefits for all Generations

By the PSC Social Safety Net Working Group, April 2012

[NOTE: In this web version, information about Social Security has been updated per the 2013 Trustees’ report.]

Click here for a PDF of this brochure. Print copies are available at the PSC. As workers, we’ve earned our network of benefits, and we must fight to keep them. National safety net programs, public pensions and other benefits are under attack. These attacks on Social Security, Medicare, employee health benefits, and pensions have led the Professional Staff Congress/CUNY (PSC) to organize a campaign in defense of the social safety net.

As workers, we’ve earned our network of benefits, and we must fight to keep them. National safety net programs, public pensions and other benefits are under attack. These attacks on Social Security, Medicare, employee health benefits, and pensions have led the Professional Staff Congress/CUNY (PSC) to organize a campaign in defense of the social safety net.

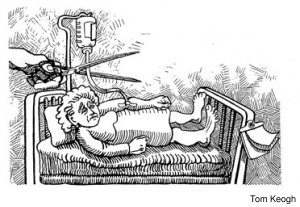

Without a social safety net¬—a set of federal, state and local programs, legislated and contractual, intended to provide protection against economic calamity—anyone facing old age, infirmity, the unexpected misfortune of unemployment, disability or the death of a wage earner, runs the risk of being unable to fend for herself.

Defending the social safety net is critical not only to PSC retirees dependent on Social Security, Medicare and their pensions now, but especially to younger, active members of the Professional Staff Congress, so they will be able to enjoy life’s pleasures after long years of hard work. Just as important, the future security of the next generations depends on our actions to defend the social safety net today.

The Social Safety Net

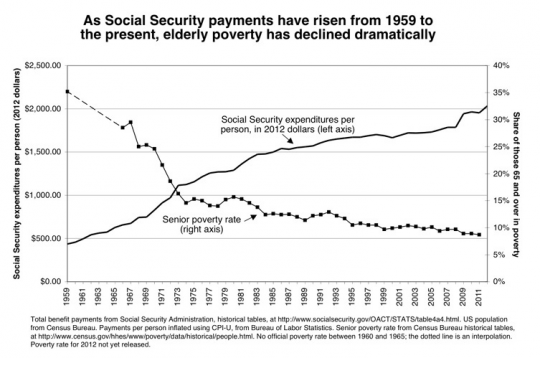

Social insurance, of which Social Security is the foundation in the United States, encompasses broad-based programs that insure workers and their families against economic insecurity caused by loss of income from work and the cost of health care. (Figure 1) It includes Social Security, Medicare, Medicaid, workers’ compensation, and unemployment insurance, related public assistance and private employee benefits.

[FIGURE 1]

With minor adjustments, the Social Security Trust Fund will provide old age and disability insurance for all American workers now employed, as well as economic security for dependents of deceased workers (dependent spouses must be at least 60). Social Security did not cause and is unrelated to the federal deficit. This self-sustaining program is funded by payments from the Social Security Trust Fund and does not use general tax revenues to pay benefits. It works for most people, but same-sex couples and their families do not receive spousal and dependent benefits.

With minor adjustments, the Social Security Trust Fund will provide old age and disability insurance for all American workers now employed, as well as economic security for dependents of deceased workers (dependent spouses must be at least 60). Social Security did not cause and is unrelated to the federal deficit. This self-sustaining program is funded by payments from the Social Security Trust Fund and does not use general tax revenues to pay benefits. It works for most people, but same-sex couples and their families do not receive spousal and dependent benefits.

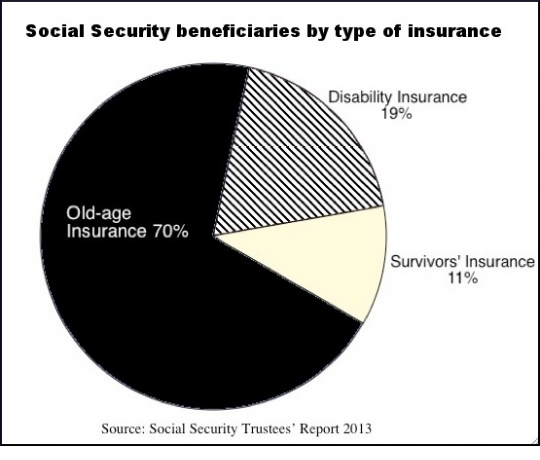

Social Security is not an “entitlement” program but a social compact between generations (current workers paying the benefits of current retirees) and an insurance policy that grants economic protection from birth to death. Throughout our working lives, employees and employers pay a “premium” for this comprehensive family insurance (equivalent to a policy worth $500,000) through Social Security taxes (FICA) on weekly earnings. When a working person dies or becomes disabled, his or her dependents receive substantial monthly benefits. At retirement, workers collect Social Security benefits for the rest of their lives. Of the 57 million people currently receiving Social Security benefits, 40 million are retirees and their dependents, 11 million are disabled workers and their dependents, and 6 million are survivors of deceased workers.

[Figure 2]

American workers who still have jobs face declining real wages and diminished benefits, where they have benefits at all. Tens of millions more are unemployed or underemployed, and over 45 million lack health insurance. Political decisions—how money is spent and who antes up—drive current assaults on Social Security, public sector pensions and healthcare. The issue is not lack of resources. After billions spent for wars in Afghanistan and Iraq, for the bailout of Wall Street and for slashing taxes on the wealthy, the Right claims there is a fiscal crisis. Their agenda punishes working families with cuts in basic services, decimates public-sector unions and undermines the well-being of future generations. Public-sector workers are now being blamed for a mess caused by private-sector interests that still have not been held to account and are amassing even greater fortunes than before the crisis. Ironically, the very people often blamed are among the most victimized by the economic crisis, having seen savings and the value of homes and other retirement assets vastly diminished.

American workers who still have jobs face declining real wages and diminished benefits, where they have benefits at all. Tens of millions more are unemployed or underemployed, and over 45 million lack health insurance. Political decisions—how money is spent and who antes up—drive current assaults on Social Security, public sector pensions and healthcare. The issue is not lack of resources. After billions spent for wars in Afghanistan and Iraq, for the bailout of Wall Street and for slashing taxes on the wealthy, the Right claims there is a fiscal crisis. Their agenda punishes working families with cuts in basic services, decimates public-sector unions and undermines the well-being of future generations. Public-sector workers are now being blamed for a mess caused by private-sector interests that still have not been held to account and are amassing even greater fortunes than before the crisis. Ironically, the very people often blamed are among the most victimized by the economic crisis, having seen savings and the value of homes and other retirement assets vastly diminished.

American workers must engage in national, state and city budget fights, as well as local contract campaigns, to defend the social safety net. It may feel like a daunting task, but the PSC Social Safety Net Working Group’s approach is to work incrementally, member-to-member. We intend to

- educate active and retired PSC members, especially younger, active members, about social safety net programs;

- dispel misinformation that undermines support for the social safety net;

- mobilize ourselves and work in coalitions to defend the social safety net.

Social Security Under Attack

Contrary to a massive and dishonest campaign to undermine it, Social Security is doing well. Attacks are motivated by anti-tax, pro-privatization, anti-safety net ideologies. In fact, the Social Security Trust Fund had a $2.73 trillion surplus at the end of 2012 and can pay all currently promised benefits through 2032, 77% of currently promised benefits through 2086 and 72% after that. The Trust Fund invests in U.S. government bonds, backed by the full faith and credit of the government. Even though Congress committed to maintain funding for Social Security through the general budget when it extended the reduction In the payroll tax in February 2012, It set a dangerous precedent. Substituting general fund dollars for employee FICA contributions makes the Social Security Trust Fund vulnerable to Congressional “fiscal austerity” measures. Among the proposals offered to “fix Social Security” are some that will enhance it and some that will greatly weaken it.

Ways to enhance the Social Security Trust Fund

The financing of Social Security is in good shape but could be made even stronger by implementing the following:

- Lift the cap on FICA wages: Levy the FICA payroll tax on annual wages above $113,700 (the cap in 2013) to ensure benefit payments for the indefinite future.

- Dedicate the estate tax to Social Security: Reinstate the estate tax to the 2009 level and dedicate the increased revenue to Social Security to generate almost as much money as raising the retirement age to 70.

- Increase the FICA tax rate by 2.66 percentage points (1.33 percentage points each for employer and employee). An increased rate, even if implemented gradually (0.2 percentage point per year), would ensure the long-term solvency of Social Security.

Destructive proposals to “fix” Social Security

Several proposals would effectively cut benefits for the most elderly and most vulnerable, and they make no economic sense. These “fixes” add up to four assaults:

- Raising the retirement age would result in a substantial benefit cut for future retirees and would disproportionately affect lower-income, disadvantaged populations with lower life expectancies.

- Reducing the annual Cost-of-Living Adjustment (COLA) would, according to the Congressional Budget Office, “save” (reduce benefits by) $108 billion over 10 years. The annual, automatic COLA, averaging about 3% per year for most of the last 25 years, protects against an inflation-related erosion of benefits. As retirees age and other non-Social Security sources of income fall, relatively, the importance of a fair COLA grows, particularly when health care costs are rising faster than inflation.

- Price indexing, inaccurately called “progressive” price indexing, is a related strategy that would disconnect the benefit formula from wages and connect it to prices. Linking benefits to prices is likely to understate the expenses most retirees face.

- Means-testing would change Social Security into a welfare program based on need, and would exclude higher income earners, without producing significant savings. By undermining the broad political base for Social Security, means testing threatens the future of a program that is now an earned and paid-for right of all workers.

Pensions Under Pressure

Amid the attacks on public-sector workers and our families, nothing stands out more starkly than the attempt to undo pension benefits, prospective and current. All public pension plans have suffered from the collapse of the financial markets in 2008-2009, and some are indeed in crisis, notably those in California and New Jersey where huge “unfunded liabilities” resulted from decisions by governors not to meet their obligations to make contributions into the plans. Also, some public pension trustees made risky investments. Such is not the case in New York where both NY State Comptroller DiNapoli and NY City Comptroller Liu report that public pension systems are well-funded.

Even in the mid-19th century, long before public police officers, firefighters and school teachers had the right to bargain collectively, cities and states supplemented wages with the promise of pensions upon retirement. In modern times, pensions continue to be provided as part of overall compensation promised in good faith by public employers. Pensions are part of public employers’ total compensation package, and a part to which the public employees themselves, in almost all cases, also contribute. States have different laws, rules and guarantees concerning public pensions. New York law covers state and local employee pensions. The state constitution protects current employees’ pension rights concerning eligibility and benefit formulas, but the Legislature and the Governor can amend the laws as to prospective employees.

During Fiscal Year 2010, employer contributions to NYC Teachers Retirement System (TRS) totaled $2.6 billion, and employee contributions totaled $138 million. Total net assets—held in trust to pay pension benefits—were $26.4 billion as of 6/30/10, a decline of 29% from assets’ peak value in 2007. Both the State and City Comptrollers reported healthy returns for Fiscal Year 2011—an average rate of return of 14.6% for State pension funds in Fiscal Year 2011 and 23.2% for City pension funds in Fiscal Year 2011.

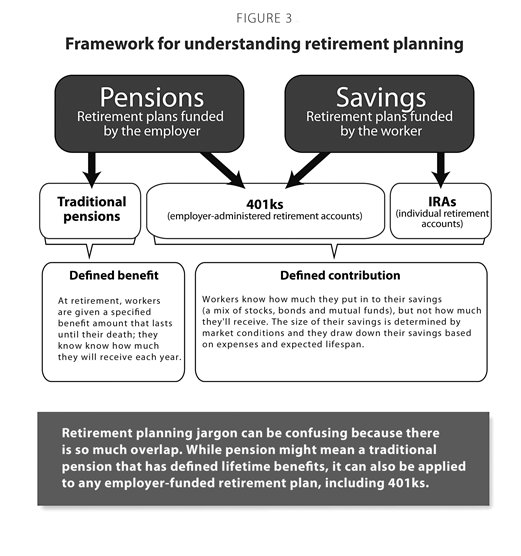

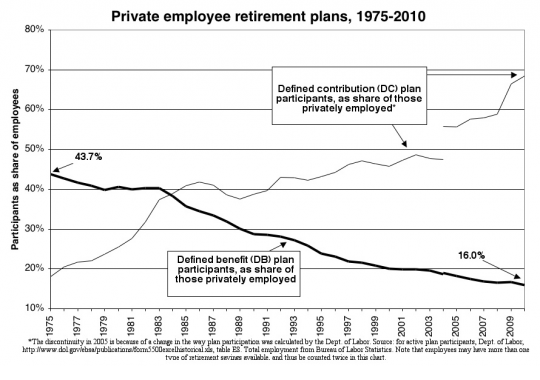

At CUNY, both employees and the University make contributions to pension accrual. Full-time PSC members are eligible for and must choose one of two types of pension plans —a defined-benefit or a defined contribution plan (Figure 3). Part-timers can join CUNY’s defined-benefit plan, the New York City Teachers Retirement System (TRS). A “defined-benefit plan” such as TRS guarantees a certain benefit level on retirement, based on years of service and earnings. (For example, the average annual retirement allowance for NYC TRS retirees [which also include NYC K-12 teachers] as of 6/30/10 was $43,381.)

A “defined contribution plan” (such as CUNY’s Optional Retirement Plan, [primarily TIAA-CREF] pays a retirement benefit that is a function of the amount contributed and the investment earnings on that amount, which can leave the individual pensioner’s benefit at the mercy of the financial markets and dependent on one’s capacity to save a substantial amount consistently for retirement. (CUNY employees also have the option to contribute voluntarily to a 403(b) plan in addition to either type of pension plan.)

[Figure 4]

In New York, Mayor Bloomberg and Governors Paterson and Cuomo have spent the last few years asserting the need to change public pensions. A new Tier 5 pension plan was enacted for most new State employees (but not CUNY employees) in 2009. Now Cuomo and the Legislature have passed Tier 6, effective April 1, 2012, which requires newly-employed public sector workers (including at CUNY) to pay more into their pension funds and work longer, while public employers like CUNY pay less, resulting in retirement benefits that will be lower than those for employees in Tiers 1 to 4. Also, it will take twice as long to vest under Tier 6, which puts the opportunity of earning retirement benefits out of reach for most P/T faculty who will have to work at CUNY more than 20 years to vest. Significantly, both the NYC and NYS Comptrollers, responsible for supervising the public pension plans, have repeatedly challenged claims that the pre-Tier 6 public pension plans are not sustainable.

The PSC has fought against new tiers that diminish the pension benefits of new generations of faculty and staff; the union will continue to do so with even greater urgency in this period of unrelenting attacks on the social safety net.

Health Care – A Right Not a Privilege

Like retirement security, physical well-being should not depend on ability to pay. The profits and costs of the private, insurance-based health care system are rising faster than almost any other sector of the economy. Therefore, health insurance has become an increasingly expensive element of compensation, and workers often have to choose between increased wages and paying a larger share of health care costs. Medicare and Medicaid, the public health insurance programs for the elderly and the poor, are both under-funded and, like the rest of the health care system, burdened by rapidly rising costs. Unless healthcare is adequately funded and costs contained, the system will collapse for all but the very rich.

Like retirement security, physical well-being should not depend on ability to pay. The profits and costs of the private, insurance-based health care system are rising faster than almost any other sector of the economy. Therefore, health insurance has become an increasingly expensive element of compensation, and workers often have to choose between increased wages and paying a larger share of health care costs. Medicare and Medicaid, the public health insurance programs for the elderly and the poor, are both under-funded and, like the rest of the health care system, burdened by rapidly rising costs. Unless healthcare is adequately funded and costs contained, the system will collapse for all but the very rich.

The PSC has endorsed “single-payer” health care. A single-payer health care system would collect contributions for coverage—whether through employers or taxes—and then pay for all services through the government or a government-related provider. A single-payer health care system would cover everyone and, through economies of scale, control costs and allow for consumer choice.

Until the passage of national health care reform legislation in 2010, no mandate existed requiring employers to provide health benefits to employees, but New York City employees have received health benefits since shortly after World War II. Later on, after unionization of most City employees, eligible retired city workers started receiving health insurance. The Municipal Labor Committee (MLC)—a coalition of all NYC municipal employee unions—and the City’s Office of Labor Relations (OLR) negotiate over the range of insurance plans and benefits offered, deductibles, co-payments, etc. As the health insurance plan benefit costs rise, the City seeks to pass more and more of the cost increases on to active and retired City employees. Full-time PSC members have a range of health insurance options from which to choose, some contributory and some not, administered through the NYC Employee Health Benefits Program. Under the PSC collective bargaining agreement with CUNY, the PSC/CUNY Welfare Fund has administered health insurance benefits for eligible adjuncts since the mid-1980s. CUNY has long resisted union demands to put adjunct health coverage on a more sustainable footing, and it has underfunded adjunct health insurance for years. In September 2011, the PSC launched an urgent campaign to save adjunct health insurance, after the Welfare Fund announced it could no longer subsidize the benefit. (See psc-cuny.org for details.) In a victory for PSC, additional State funding for adjunct health insurance was gained in the new budget, and the union and CUNY are negotiating the integration of eligible adjuncts into the City health plan.

For PSC members who retire and who meet the eligibility threshold, health insurance coverage continues until age 65, when City health insurance begins to supplement Medicare. Retiree health benefits are negotiated between the MLC and the City.

The PSC-CUNY Welfare Fund provides supplemental benefits, ranging from prescription drugs to dental care to optical benefits and more. Funding is provided by CUNY on a per capita basis for full-time employees and retirees and is bargained by the PSC and CUNY under guidelines negotiated by the MLC and OLR.

Medicare under Assault

Medicare is currently under political attack as too costly, even though the Congressional Budget Office recently estimated that it is 11% cheaper than equivalent private insurance plans. The basic insurance plan is not the problem, but longer life expectancy, skyrocketing drug costs and rapidly expanding medical costs within the privatized fee-for-service model of the US healthcare system have resulted in increased costs. Recent federal health care reform legislation imposes a variety of changes on Medicare, including various cost-containment strategies.

Medicare is a national health insurance plan enacted in 1965 as an extension of Social Security. It covers up to 80% of hospital, doctor and outpatient costs for persons 65 and older. Part A, which works fairly well, covers medically necessary hospital, skilled nursing facility, home health and hospice care and is paid for by employee and employer contributions through payroll deductions. These benefits are free if you’ve worked and paid Social Security taxes for 10 years. On the other hand, Medicare Parts B, C and D are funded from the annual federal budget plus subscriber fees paid by enrollees. For public employees in NYC, as a result of negotiations between the MLC and OLR, the City now reimburses eligible full-time retirees for their Medicare Part B premium payments (covering doctor’s visits and outpatient care) for themselves and their spouses. Part D is Medicare’s optional prescription drug plan, designed as a catastrophic plan and implemented in 2006.

The 2010 health care reform legislation resulted in such significant parameter changes that, in early 2012, the Welfare Fund was able to enroll all of its Medicare retirees in a joint Medco-Medicare Part D program. For enrollees, a first layer of cost is met by Medicare, and then Medco makes up the difference to mimic the previous Medco benefit. The combined program eliminates premiums and “donut holes,” removes the annual $10,000 cap, lowers co-pays for high utilizers and saves the Welfare Fund money.. Part C is not a separate benefit; it permits (and in some cases over-subsidizes) private health insurance companies (through HMOs and PPOs) to provide Medicare benefits and was part of a Bush administration effort to privatize Medicare.

A Republican proposal for a Medicare voucher system would gradually shift Medicare costs from the federal government to senior citizens and local governments (when seniors become impoverished and need Medicaid). As an alternative, the Congressional Progressive Caucus proposes maintaining physician reimbursement rates at current levels (to keep doctors in the system); establishing a public insurance option (based on Medicare) to compete with private plans; and aligning Medicare drug payment policies with the more cost-effective Medicaid policies.

Medicaid at Risk

Medicaid—health insurance for the poor—is jointly paid for by the federal government and the states. The federal government sets basic requirements and guidelines, and the states implement them and pay for any supplementary benefits they provide. Retirees and the elderly depend on Medicaid as well as Medicare when their assets and income fall below specified limits. Historically, NY State has been creative in stimulating cost-effective health care for the elderly, such as Medicaid support for home care. Home care is less expensive than institutionalization and many elderly patients prefer to live at home if they are able. With pressures at both the national and state levels to reduce the rate of increase in Medicaid spending by government, quality of care will be of increasing concern.

PSC members—active and retired—must join the movement to contain health care costs and maintain benefits. We must join coalitions to pressure legislatures to enact patient-friendly regulation of the health care industry and tax increases to generate sufficient revenue, as well as seriously consider a single-payer system. We must resist Mayor Bloomberg’s and Governor Cuomo’s persistent pressure to reduce retiree health benefits and diminish pensions, for us and for those who come after us.

Other Strands of the Social Safety Net Unraveling

Two state-based safety net programs that are woefully underfunded also need legislative attention: workers’ compensation and unemployment insurance. The NY State workers’ compensation program provides disability benefits to workers injured on the job and is funded by employer contributions. Economies of scale make state management of this benefit much more cost-effective than buying individual insurance polices; a state program also ensures equal standards and benefits for all workers across New York. Unemployment insurance (UI) was established as part of the Social Security Act of 1935, which required states to establish programs and provided federal assistance to state-sponsored plans.

At a time when working people need access to both programs, benefits have been reduced or are at risk because of so-called “cost-containment” measures put in place by elected officials in Albany. In New York’s workers’ compensation program, for example, Governor Spitzer capped the duration of partial disability benefits and used the money to reduce employer premiums. Actions that other states have taken include increasing eligibility standards and reducing the duration of benefits for workers’ compensation, as well as changing qualification and re-qualification requirements for unemployment insurance, in spite of federal minimum standards. States have also diverted funds allocated to these benefits to close state budget gaps.

Conclusion and Call To Action

United—and militant—we stand. Divided—and passive —we fall.

Even as you read this, cuts are being proposed and bills are being printed. The “Super Committeee” established by Congress in fall 2011 failed to agree on across-the-board spending cuts, so predetermined cuts and spending caps will come into effect in January 2013. In the meantime, Republicans are proposing more drastic cuts to the social safety net. The Congressional Progressive Caucus has proposed a “Budget for All” for fiscal 2013 which would emphasize spending increases In the near term to support economic recovery and fiscal responsibility to narrow the deficit In the longer term. The Caucus’ explicit goal is to “put Americans back to work and protect Medicare, Medicaid and Social Security.”

We must also be ready to act quickly in support of good policy recommendations, and we must fight back against cuts that could increase economic insecurity and reduce access to health care for millions of Americans.

The Social Safety Net programs described in this brochure are aspects of American society to be proud of. They express the social relations of cooperation and solidarity that any decent people would want to promote and even improve: care for one another, especially seniors, the disabled, the young, the sick. These are our loved ones we are talking about: family, friends, neighbors, co-workers. We are a people who collectively build and sustain a society and its institutions: family, school, hospital, workplace, community, government. We are not just a haphazard mix of isolated individuals.

We are at a crossroads. What kind of people will we be? Generous, cooperative, caring, just? Or mean-spirited, dog-eat-dog, narrow minded, greedy? The PSC chooses life, freedom, equality, community, solidarity.

These ideals will not be realized in our social relations and policies without action—organized, militant action. We are launching a campaign to defend and improve the social safety net by political action:

- Engaging in legislative and electoral work;

- Organizing PSC members, and then their networks of family, friends, and neighbors for engaged involvement;

- Presenting conferences and events, and using electronic and print media to educate and mobilize the public;

- Working with allies in other unions and community organizations;

- Initiating public demonstrations, including direct action.

This social safety net is ours. We worked for it, we contributed to it, we negotiated for it. We will not let the very few, the very rich, the very powerful (and those whom they have fooled) destroy it. Despite the economic crisis, this is still a country of great resources and wealth, enough for wars, bailouts, subsidies and tax breaks for the rich.

Sign up as an active member of the PSC Social Safety Net Campaign. (Visit psc-cuny.org/social-safety-net for contact information.) Receive information on political developments, participate in meetings, events, and actions. Contribute your ideas and energy. Join with your co-workers, union sisters and brothers, and community members to protect and enhance the programs we are proud of, and that make our lives better.

Online Resources

Research and Information

- Center for Economic and Policy Research—cepr.net

- Economic Policy Institute—epi.org

- Fiscal Policy Institute—fiscalpolicy.org

- National Academy of Social Insurance—nasi.org

- New York City Comptroller—comptroller.nyc.gov

- New York State Comptroller—osc.state.ny.us

- Teachers’ Retirement System (TRS) of the City of New York—trsnyc.org

- TIAA-CREF—tiaa-cref.org

The Social Safety Net Working Group has created a slide show summarizing the key points in this brochure which you can share with others at home, at work or with community organizations. It is available as a Powerpoint presentation and a PDF.

Advocacy

- American Association of University professors (AAUP)—aaup.org/AAUP/involved/lobby

- American Federation of Teachers—aft.org/getinvolved

- Alliance for Retired Americans—retiredamericans.org

- National Committee to Preserve Social Security and Medicare—ncpssm.org

- National Education Association—www.nea.org/home/IssuesAndAction.html

- New York State United Teachers—nysut.org

- Professional Staff Congress/CUNY—psc-cuny.org

- Strengthen Social Security/Social Security Works—strengthensocialsecurity.org

The PSC Social Safety Net Working Group

John Hyland, LaGuardia Community College, Retired, Co-chair

Steve Leberstein, City College of New York, retired, Co-chair

Joel Berger, College of Staten Island, Retired

Francine Brewer, LaGuardia Community College, Retired

Diane DiMartino, New York City College of Technology, Retired

Bill Friedheim, Borough of Manhattan Community College, Retired

Jack Judd, Lehman College, Retired

Dave Kotelchuck, Hunter College, Retired

Brent Kramer

Cecelia McCall, Baruch College, Retired

Eileen Moran, Queens College, Retired

Jim Perlstein, Borough of Manhattan Community College, Retired

Evie Rich, Hunter College, Retired

Click here for a PDF of this brochure.

April 2012

| Attachment | Size |

|---|---|

| 1.17 MB |