Governor Kathy Hochul released her budget proposal in mid-January. What’s the verdict? So far: It provides a modest increase in CUNY funding, but not enough to address faculty and staff losses in the Cuomo era. The PSC is part of a coalition advocating for increased tax revenue to offset federal cuts, fund general operations, and enact a bold affordability agenda. With federal cuts to Medicaid and other programs blowing a hole in the state budget and Mayor Zohran Mamdani announcing a $12 billion budget deficit for the city, new tax revenue is needed now more than ever.

Heather James-Zuckerman: ‘Taxing the rich is common sense and it is possible.’ (Credit: PAUL FRANGIPANE)

PSC President James Davis said: “Governor Hochul’s Executive Budget holds the line on tuition, expands access to free community college, and increases CUNY’s operating budget. These welcome investments are essential to making life in New York more affordable. So too, however, is ensuring the ultra-rich pay their fair share in taxes. Revenue raisers are essentially absent from the Governor’s plan, but they must be in the final enacted budget.”

He added, “Fairly taxing wealthy corporations and the rich is how Albany can end CUNY’s full-time faculty and staff shortage and fund a New Deal for CUNY. A truly progressive revenue platform will protect schools and hospitals and the many public services on which we rely by offsetting the MAGA Congress’s cuts to health care and food assistance. It can fund universal childcare and free buses and safeguard our state and city from additional federal cuts.”

The Governor’s Executive Budget for next fiscal year increases CUNY senior college operating funding by $28 million and it adds $23.5 million to cover increasing faculty and staff fringe benefit costs.

When Governor Hochul took office, she dedicated $53 million for CUNY to hire full-time faculty. The investment was a rejection of Governor Cuomo’s systematic underfunding of higher education and a response to advocacy to enact a New Deal for CUNY. This year’s Executive Budget extends support for those hires – approximately 500 lecturer and professorial lines

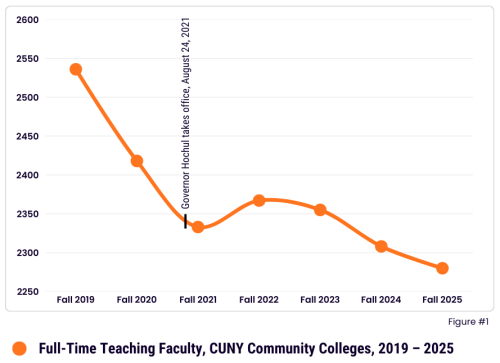

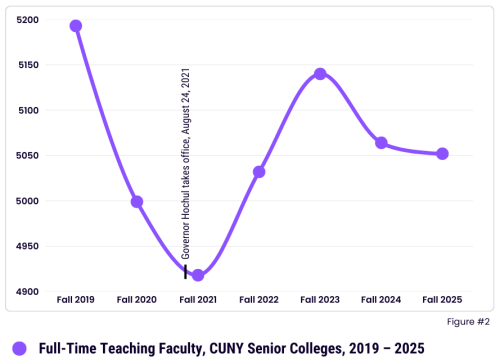

“The PSC is grateful for the earmarked faculty funding because it means that CUNY must use these funds for these full-time teaching positions,” said Jen Gaboury, PSC’s first vice president. “However, since Hochul took office at the Senior Colleges we are only up 134 lines and at the Community Colleges we are down 53 lines. The University is failing to replace full-time lines when people leave or retire. Protecting lines meant to rebuild the full-time faculty must be a priority for CUNY.”

Recent gains in CUNY’s full-time faculty have been eroded by attrition and outpaced by enrollment growth. CUNY’s full-time faculty count is still lower than it was before the pandemic.

Compared to Fall 2019, the Senior Colleges have 141 fewer full-time faculty, and the Community Colleges have 256 fewer full-time faculty. (See Figures 1 and 2.)

The PSC is championing a budget platform that includes $92 million earmarked for 1,000 full-time faculty and $16 million for 55 new advisors and 40 new mental health counselors. The faculty and staff are needed for both the senior colleges and the community colleges.

A new student emergency aid program is proposed in the budget with $400,000 for CUNY to use to help with unforeseen, urgent needs like food, housing, and childcare.

Community colleges are proposed to receive the same operating funding as last year, maintaining the “funding floor” at 100% of prior year funding, as they say in Albany budget parlance. State budgets for the last four years have maintained prior-year funding and sidestepped the enrollment-based funding model for community colleges to avoid deep budget cuts that would have resulted from pandemic-driven enrollment declines. Enrollment at the CUNY community colleges is trending up, but is still lower than it was prior to the pandemic.

Funding increases provided by the Legislature in the last round of budget negotiations for the opportunity program SEEK/College Discovery, the Murphy Institute/School of Labor and Urban Studies, Black Male Initiative, and other programs were not included in Hochul’s plan. The State Senate and Assembly will have to negotiate to restore funding to these programs.

CUNY Chancellor Félix V. Matos Rodríguez praised Hochul’s free community college program, which was announced last year as the Opportunity Promise Scholarship and has since been renamed SUNY CUNY Reconnect. The program has driven much of this year’s enrollment growth saying, “Since its launch last year, Reconnect has enabled nearly 6,000 New Yorkers ages 25 to 55 to enroll at CUNY,” adding that “Continued state support will allow us to reach more students.”

Overall CUNY enrollment increased by 9,000 in the past year and by nearly 21,000 since 2022.

CUNY Reconnect, offers free tuition, covers expenses for fees and books for applicants ages 25 to 55 at community colleges studying in more than 120 high-demand fields, including nursing, health sciences, cyber security, and education. It’s a welcome development to be sure, but the PSC believes that the governor needs to match that well-intentioned initiative with more operating funding; if more students are coming into the already crowded CUNY two-year schools, these schools will need more funding from both the city and state, PSC officials said. The union is also pushing to expand the program to cover associate programs offered at the three CUNY comprehensive colleges, College of Staten Island, City Tech, and Medgar Evers College.

The governor’s Executive Budget also includes nearly $400 million in capital funding for critical maintenance at the senior colleges and to match City investments at the community colleges.

Increasing State and City Tax Revenue

Fiscal Policy Institute Executive Director Nathan Gusdorf noted the absence of taxation revenue proposals in the budget plan. The “Executive Budget makes no authorization for New York City to raise its own taxes, a step that will be necessary for Mayor Mamdani to close the deficits left behind by the Adams administration and pursue the affordability agenda on which he was elected,” he said.

On the one hand, the “Executive Budget also extends the current corporate tax rate of 7.25 percent for corporations with over $5 million in profits, preventing an imminent loss of one billion dollars in annual revenue under the currently planned corporate tax cut,” Gusdorf said. However, he added that the state budget must empower the new mayor to enact new taxes on the rich to sustain an agenda for affordability. In November last year FPI estimated that millionaires throughout New York State will save $12 billion this year from federal tax cuts under the [federal One Big Beautiful Bill Act],” he said. “Approximately half of that–$6 billion–will flow to millionaires living in New York City.”

Absent additional state revenue directed to public higher education, CUNY can’t regain institutional integrity. The PSC is pushing for a robust tax plan. Heather James-Zuckerman, an associate professor of political science at Borough of Manhattan Community College and the union’s legislative chair, broke down the proposals.

“Progressive State Income Tax Bill (S.1622-Jackson/A.1281-Meeks) expands the existing personal income tax brackets in New York State, and more than doubles the top marginal tax rate to raise an additional $10 billion in annual state revenue,” she said. “Fair Share Act (S.8577-Liu/A.8953-Souffrant Forrest) authorizes New York City to charge an additional 2% on all income earned in excess of $1,000,000 to generate an additional $4 billion in annual tax revenue for New York City.”

She added, “Corporate Tax on the Most Profitable Corporations (S.953/A.1971-Kelles) increases the corporate tax rate to 8% for corporations with income over $2.5 million, 12% for companies with income over $10 million, and 14% for companies with income over $20 million to raise an additional $7 billion in annual state revenue.”

The union is still pushing the REPAIR Act (S.1419-Liu/A898), which would amend, “the State constitution to end property tax exemptions for private universities receiving breaks of over $100 million annually (currently Columbia and NYU),” James-Zuckerman said, noting that a “follow-up bill would direct $300 million in reclaimed additional tax revenue to CUNY.”

For James-Zuckerman, this is all an opportunity to create a more equitable state budget and protect the state from federal attacks down the line.

“Drastic federal cuts by the Trump administration have harmed the state’s budgetary outlook and put additional pressure on public services. In light of these fiscal challenges, a core party of PSC’s strategy this year is working with partners to fight for more revenue by taxing the rich,” she said. “The 128 billionaires in New York grew their wealth by $332 billion in the last seven years–since the 2017 tax cuts–while one in five New York children live in poverty. And it is the middle class that are leaving New York, not the rich. That is because the middle class can’t afford to stay. Taxing the rich is common sense and it is possible.”

Budget negotiations between the legislature and the governor have begun, and lawmakers must reach a budget agreement by the April 1 deadline, though in recent years the April 1 deadline wasn’t met in time. The PSC will be mobilizing its members in legislators’ districts and in Albany to push lawmakers to enact a final budget that creates new tax revenue.

The union has joined over two dozen organizations around the state to mobilize thousands of New Yorkers for a Tax the Rich rally outside the Capitol in Albany on February 25. Mayor Mamdani, too, underscored the need for more revenue for the city especially.

“Thanks to the Governor’s fiscal stewardship and the strength of New York City’s tax base, the State is on solid financial footing,” he said in response to the budget proposal. “The City, however, is not—and that is the direct result of Eric Adams’ gross fiscal mismanagement. Years of short-term gimmicks with long-term consequences have left behind a significant budget gap, putting our city on an unsustainable path.”

He added, “We will not continue the pattern of sweeping problems under the rug. In their latest reports, the City and State Comptrollers identified a $12 – $13 billion budget gap over two years. The findings of the City and State Comptrollers are in line with our assessment, so far. My administration will not repeat the mistakes of the past. We will restore long-term stability.”

Published: February 9, 2026 | Last Modified: February 11, 2026