|

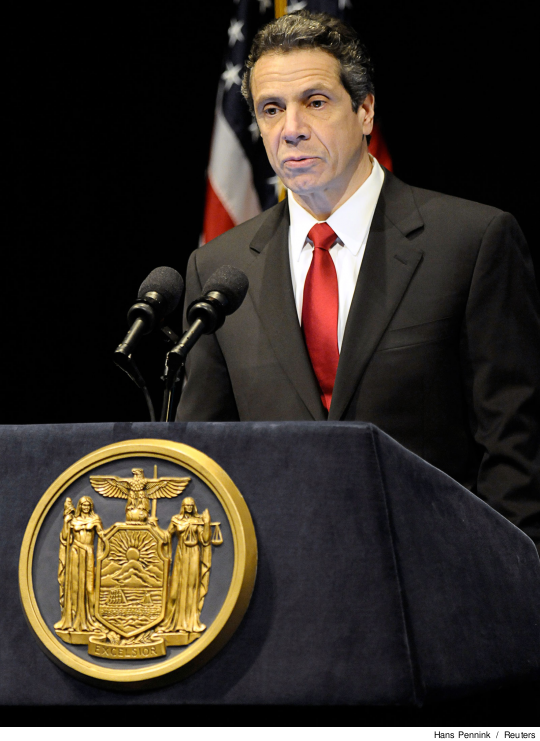

It seems like only yesterday that New York imposed a new fifth pension tier for State workers, but Governor Andrew Cuomo is now proposing a sixth one, which would reduce retirement benefits drastically for future employees. As The New York Times reported in June, Cuomo’s plan would raise the retirement age from 62 to 65 for State workers, and from 57 to 65 for public-school teachers; raise the employee pension contribution from 3% of salary to 6%; and “ban the use of unused sick leave or unused vacation time to enhance an employee’s pension calculation.”

The changes would affect those hired in the future, because the New York State constitution prohibits cutting basic retirement benefits for current employees.

BAD COMPANY

Cuomo is joining the ranks of other governors, like his neighbor Chris Christie of New Jersey, who blame state budget problems on the compensation of state workers but refuse to consider rolling back some of the tax breaks awarded in recent years to the richest residents.

“A lower pension tier is a bogus solution to the State budget deficit,” said PSC President Barbara Bowen. “Tier 6 would not produce any new income for the State in the short term—and the State’s budget problem is immediate, not ten years away.

“Calling for a lower pension tier is pure political opportunism,” Bowen added. “Not one word should be said about slashing workers’ salaries and benefits while New York State is still handing a tax break to billionaires.”

In a July 13 interview, Cuomo vowed to the Times that the pension cutbacks would be his top legislative priority in the coming year. The current public-worker pension system, Cuomo said, is unsustainable. But that claim doesn’t stand up to scrutiny. As with the Tier 5 pension, the new reforms, if imposed, would not reap any financial benefit for the State for at least another generation, resulting in no relief for the current budget shortfall. Moreover, explained Frank Mauro, executive director of the Fiscal Policy Institute, Cuomo is attacking a non-existent crisis.

“The biggest problem that exists nationally with pensions doesn’t exist in New York, and that is under-funding,” he said. “The New York State pension funds are among the most fully funded in the country.”

One reason for this, Mauro noted, was that when pension investment returns fell, employer contributions into the funds automatically increased. “This is one way where it is very fiscally prudent,” he said of the retirement system.

HIGH RETURNS

Current returns for both State and City pension systems have been quite healthy. On July 14, State Comptroller Tom DiNapoli reported that New York’s Common Retirement Fund had earned a 14.6% rate of return. “The Fund remained resilient during a tough economic period,” DiNapoli said. “The strong returns should reassure our beneficiaries and New York taxpayers that the Fund is strong and sustainable.”

City Comptroller John Liu announced July 5 that New York City pension funds achieved a 20% return – their highest in 13 years, “While the markets remain volatile, we have vigorously pursued a diversification strategy to enhance our returns while lowering pension costs to the City,” Liu said in a statement. “This will protect pensioners and taxpayers alike in the long run.”

Anti-labor politicians and news media often ignore the big picture, preferring to cherry-pick a handful of cases where civil servants’ pensions are boosted by large amounts of overtime in the final years of employment. Limiting this practice is part of both Tier 5 and Cuomo’s latest proposal, but Mauro called it a red herring.

EXTREME CASES

“This is something that pensions can and should crack down on, and New York State can do that,” Mauro said. But pension system critics “take these extreme cases and imply that they’re the norm when really they’re the exceptions,” he emphasized. “Most NY public employees get very modest pensions. At the State level, for career blue-collar and clerical workers, the average pension is in the high teens or the low $20,000 range.”

With the legislative session closed, the proposal is technically in limbo. But as indicated in Cuomo’s remarks to the Times, the real fight over the governor’s plan will come in the fall. Potentially affected unions have signaled their opposition.

“This is just another attack on middle-class workers at the behest of big business and corporations,” New York State United Teachers Executive Vice President Andrew Pallotta said in a statement. “This proposal would not provide a dime of savings in the near term for the state or for school districts, nor would it provide an iota of mandate relief from the pension cost spikes caused by Wall Street’s greed.”

“It would have working people working longer and receiving less,” said Stephen Madarasz, spokesperson for the Civil Service Employees Association (CSEA). “We frankly don’t believe that the Tier 6 is necessary or appropriate. We only enacted a Tier 5 less than two years ago.”

That was the same Tier 5 that both former Governor David Paterson and Mayor Michael Bloomberg said would fix the City and State’s budget problems, but that Cuomo now calls unworkable.

BURNED

Members of both the CSEA and the Public Employees Federation may feel especially burned by Cuomo’s zealousness on pensions, considering that both unions agreed to the major concessions in Tier 5 in 2009. They did so in exchange for a no-layoffs pledge from then-Governor Paterson in 2009 – but now Gov. Cuomo has used the layoffs threat to extract concessions on pay and benefits from both union leaderships. Resentment over Cuomo’s announced intention to seek further pension givebacks on top of those past concessions might sink ratification of the latest CSEA and PEF contract (see article at left).

The Times reported that in its July interview with Cuomo, the governor “criticized unions for resisting lower retirement benefits for what he described as ‘the unborn’ – future State workers for whom he wants to reduce pensions.” But State Senator Diane Savino, former chair of the State Senate Labor Committee, told The Chief that labor’s resistance is understandable because such two-tier deals result in weaker unions. “When you see a union sell out its future membership, that makes it even harder” to encourage new workers to join, Savino said.

The benefit cuts in Tier 5 were steep. Under Tier 4, employees are required to contribute 3% of their pay until they reach 10 years seniority; under Tier 5, those employees must continue those payments as long as they are on the payroll. The effect is a permanent loss of 3% of take-home pay, compared to current employees. The minimum retirement age for many workers was raised from 55 to 62, and qualifying for a Tier 5 pension benefits now begins after 10 years instead of five.

“After the PSC mobilized intense resistance in 2009 to a lower pension tier for CUNY employees – Tier 5 – New York State backed off,” said Bowen. “A lower pension tier at CUNY would seriously undermine the University’s competitiveness in national job searches.”

RELATED COVERAGE

NY State Workers Held ‘Hostage’: Gov’s Threats Win Concessions

New Jersey State Workers Take a Hit

Massachusetts Democrats Target Municipal Workers