In the wake of the Great Recession of 2008-2009, attacks against Social Security, public-sector pensions, Medicare and other social-safety-net programs escalated – a political thrust to shift the burden of municipal, state and federal budget gaps to working families and the poor.

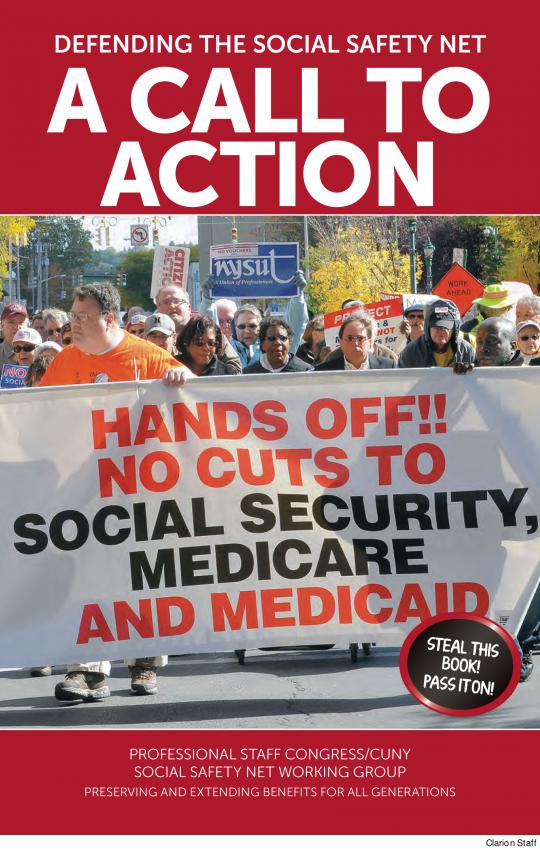

In response, the PSC Retirees’ Chapter formed a Social Safety Net Working Group in October 2010. The group produced a brochure, developed an email bulletin, spoke at PSC chapters, organized CUNY-wide forums and joined with other groups and coalitions taking action to defend and expand the safety net.

|

In 2011, the PSC Executive Council voted to expand what started out as a Retiree Chapter initiative into a union-wide campaign.

With the boost of a recent grant from the PSC’s state affiliate, New York State United Teachers (NYSUT), that initiative has now extended to a statewide audience of trade unionists, educators and community groups. The grant has funded the development of new materials and workshops, including a second edition of the working group’s pamphlet that describes and analyzes the attacks on the safety net and how best to respond (see below).

In the aftermath of the 2014 midterm elections, Washington pundits are again calling for “bipartisan action” to cut Social Security, and the PSC’s Safety Net Working Group is redoubling its efforts. If you would like to receive monthly email bulletins, arrange for a presentation to your organization, join the working group or learn more, please send an email to [email protected].

An excerpt from the Safety Net Working Group’s pamphlet, revised slightly for publication in Clarion, follows below. The pamphlet also discusses the attacks on public and private-sector pensions, Medicare and Medicaid, unemployment insurance and food stamps. It calls for a strong defense of existing safety-net programs, but also for expanding and updating them for the 21st century.

A PDF of the full pamphlet is online; print copies are available at the PSC office.

______________________________

Attacks on the safety net have been fierce, lavishly funded and sustained over the past 35 years. As workers, we must fight with a new urgency to keep and expand the benefits that we have earned.

The safety net is a set of federal, state and local programs, legislated and contractual, intended to provide protection against economic calamity. Without it, anyone facing old age, infirmity, unemployment, underemployment, disability, the death of a wage earner, below-poverty wages or contingent work runs the risk of being unable to fend for herself.

Born in Struggle

Safety-net legislation and victories spiked in two periods of intensive grassroots organizing: the labor, social and political movements of the 1930s, and the civil rights, women’s and other movements of the 1960s. Social Security, Unemployment Insurance and other programs from the New Deal date from the ’30s; Medicare, Medicaid and other Great Society programs came out of the ’60s. Every presidential administration, Democratic and Republican, from Roosevelt to Nixon, expanded the safety net.

And the Struggle Continues

Every president in the last 34 years, Republican and Democratic, from Reagan to Obama, has cut the safety net. President Obama presided over the only notable advance in this period: the expansion of health care under the Affordable Care Act (Obamacare). But he has also proposed big cuts to Social Security.

Social Security

Social Security is the most important part of the safety net in the US.

Social Security benefits are essential to the well-being of the elderly. Indeed, most elderly Americans rely heavily, or even exclusively, on them.

Current Attacks on Social Security Deny the Facts

For over three-quarters of a century, the Social Security system has been relatively healthy and working well. Employers and workers pay Social Security taxes into trust funds, which are accounts in the US Treasury. Social Security revenue is not part of the federal budget and cannot by law be used for other purposes. Payment of Social Security benefits does not contribute to the federal deficit. Social Security is and always has been a self-sustaining program that does not use general tax revenues to pay for benefits.

The Republican Party opposed the original Social Security Act of 1935, and many Republicans have opposed Social Security ever since. Their attacks in recent years have been fueled by the claim that the Social Security system would run out of money. These attacks on Social Security are dishonest and disingenuous.

The Social Security Trust Fund has always been solvent, and at the end of 2013 totaled $2.7 trillion. The Board of Trustees of the Social Security Trust Fund projects that if no changes are made to Social Security revenue or benefits, the system will be able to pay all its obligations until 2033, after which it would be able to pay three-quarters of its obligations.

Attacks on Social Security disguised as efforts to save it

- Raise the retirement age to 69 or 70 years.

This action would cut benefits by 13% or 20% (on top of the cut of 13% from the ongoing rise in retirement age to 67). Also, raising the retirement age discriminates against workers in physically demanding jobs, older and low-income workers, and especially African Americans, who are disproportionately represented among low-wage workers and the unemployed. Contrary to popular belief, life expectancy has hardly increased for low-income men over the last 25 years, and for women with low incomes it has declined.

- Reduce the annual Cost of Living Adjustment (COLA).

Social Security’s automatic, annual COLAs have averaged about 3% per year over the last 25 years, and have protected beneficiaries from erosion of their benefits due to inflation (but not from erosion due to health care cost increases). Many Republicans and some Democrats, including President Obama, want to switch to a new COLA formula called the Chained Consumer Price Index (Chained CPI), which would lead to smaller annual COLAs. According to the Congressional Budget Office, switching to Chained CPI would cut benefits by $108 billion over 10 years.

Our union and many other groups support use of the CPI-E, an index which reflects the consumer purchases of the elderly, with their increased health care costs. In May 2014, a majority of all Democratic members of Congress supported use of CPI-E to determine the annual COLA.

- Initiate means testing.

Means testing would not produce significant savings for the trust fund, but would change the nature of Social Security and threaten its future. Means testing would exclude higher-income individuals from receiving benefits, and thus threaten universal public support for Social Security. It would stigmatize Social Security as a “poor person’s” program. Social Security is an earned and paid-for right for all workers.

- Privatize Social Security.

In 2005, President George W. Bush proposed allowing active workers to opt out of Social Security and invest their savings in the stock market. Those opting out would immediately stop paying Social Security taxes, causing a sudden drop in income to the Social Security Trust Fund and threatening payments to those already retired.

This proposed initiative was defeated after opposition even from members of the president’s own party, but it sent a discouraging message to young people: you might not get Social Security benefits when you retire. By 2008, the real consequences of privatization became clear as the stock market fell and banks tottered – retiring wage earners who might have invested their retirement money in stocks and bonds under President Bush’s privatization scheme would have been devastated. The existing Social Security system, whatever its limitations, is protected by the full faith and credit of the US government.

We must defend Social Security, expand its coverage, and make its funding more equitably based.

Two Changes to Make Social Security Stronger and More Equitable

- End the tax cap on high earners.

All employees should pay the same percentage of their wages and salaries to Social Security. In 2014, if a person’s salary or wages exceeded a cap of $117,000, they paid no Social Security taxes on any income earned above the cap. The tax cap discriminates against low-wage earners by forcing them to pay a larger share of their earnings to Social Security than those earning much, much more.

- Adopt new forms of taxation to generate income to fund Social Security.

One idea is a tax on financial transactions, which makes sense because the great inequality in US income is now exacerbated by these transactions. The European Union has recommended this type of a tax and 11 of its member countries have requested to participate.

Social Security Should Cover All Residents of the US

State and local public employees weren’t included in Social Security when the program was established. Over the years, the law changed and most public workers became eligible, but there are still some state and local public workers who aren’t covered. As some cities, such as Central Falls, Rhode Island, have fallen into bankruptcy, employees in the city’s own pension plan but not Social Security have been threatened with loss of all of their benefits. The Social Security law must be amended to cover all state and city public employees.

Millions of undocumented immigrants pay Social Security taxes, but are not entitled to benefits. They should be eligible to receive benefits. Low-wage workers, including domestic workers or migrant farmworkers, should receive some Social Security benefits even if their incomes fall below current minimum requirements.

The Social Security system must catch up to the changing needs of women in the workforce. Full-time working women in the US still earn 77 cents for every dollar earned by full-time working men. Over a lifetime, women earn less pay than men, and therefore receive lower Social Security benefits. Furthermore, juggling career and family means frequent periods of part-time employment and absence from the labor market to care for children and aging parents.

The Social Security system should provide Social Security credits for workers who take time out of the workforce, or reduce their hours to serve as caregivers. The Social Security system should also increase survivor benefits, and provide equal benefits for same-sex partners in states which do not permit same-sex marriage, among other changes.